21 Sep 2020 Is Taiwan implicated in money laundering risks? Suspected financial crime company iFinex, was a client of 7 local banks

Published by Investigation team

Is Taiwan implicated in money laundering risks? Suspected financial crime company iFinex, was a client of 7 local banks

2020-09-21 Commonwealth Magazine / Yang Zhuohan

[Exclusive Cross-Country Investigation] Financial crime suspects who are now being hunted down by US justice have used Taiwan as a treasury? According to a year-long joint investigation between The World and the International Consortium of Investigative Journalists (ICIJ), it was found that several cases of money laundering or violations by banks and enterprises were all related to the cryptocurrency issuer iFinex, and Taiwanese local banks were also involved. .

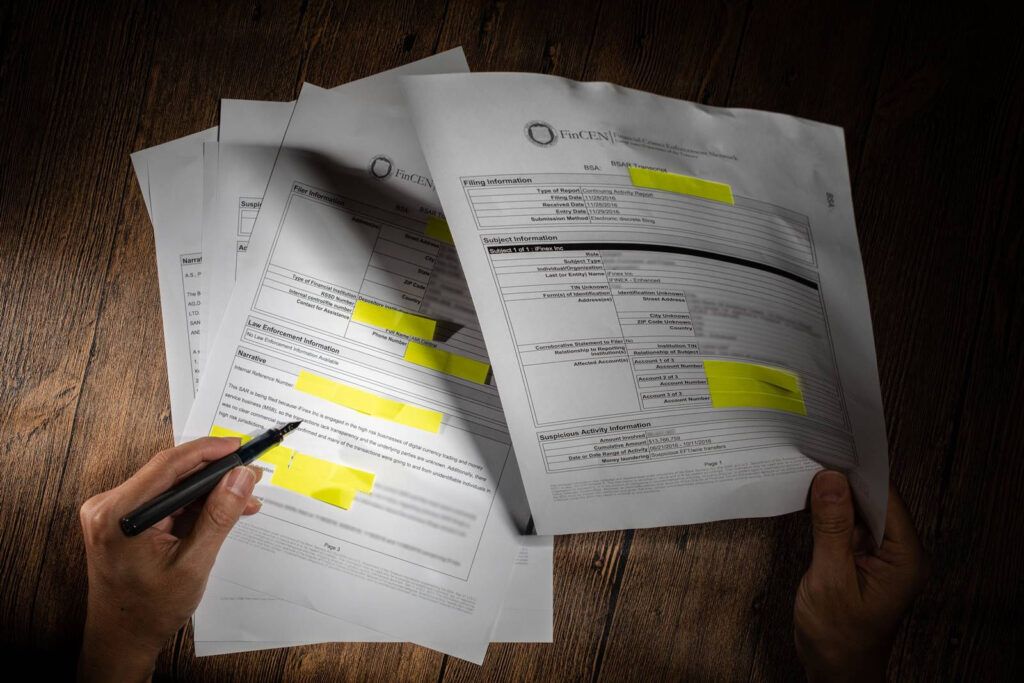

The Suspicious Activity Report (SAR), which was mainly used by the U.S. Congress to investigate Russian interference in the 2016 U.S. presidential election, is the most detailed in the history of the U.S. Treasury Department leak. Image source: Photo by Qiu Jianying

Misfortunes are mostly hidden in the subtleties, and most of the stories start from the subtleties.

The story begins with three strings of 8 numbers.

These three strings of numbers are three accounts available at Deutsche Bank in the United States, a cryptocurrency company called iFinex (which serves to buy and sell bitcoin in US dollars).

Three strings of numbers trigger the alarm bell of anti-money laundering monitoring

The company's founder, JL van der Velde, is a Taiwanese son-in-law who has achieved global fame for two things . First, he founded Bitfinex, the world's first large-scale cryptocurrency exchange; second, Tether, a related company of iFinex, issued a virtual US dollar - Tether, also known as "the central bank of the cryptocurrency industry".

Since 2015, iFinex's three strings of numbers have triggered the alarm bell of the global anti-money laundering monitoring system.

Deutsche Bank investigated suspicious transactions on the three accounts and wrote a report on November 28, 2016, to the Financial Crimes Enforcement Network (FinCen), part of the U.S. Treasury Department. The report, which appeared in the investigative database exclusively co-operated by "The World" and the International Consortium of Investigative Journalists (ICIJ), contained the names of three local Taiwanese banks.

advertise

The Deutsche Bank report is collectively referred to as the Suspicious Activity Report (SAR). The SAR is a mysterious document that banks cannot publicly acknowledge due to personal information and money laundering laws. SAR cannot be used as direct evidence in court because it is only used to monitor money laundering, not to convict. But any bank that sees a transaction that may involve money laundering has a duty to report it to the competent authorities.

The US media Buzzfeed obtained about 2,100 SARs, mainly referred to as "suspicious transaction financial files", which were reported to FinCen by the US Dollar Interchange Bank (a major international bank responsible for cross-border transfers) and shared with ICIJ. "World" and 400 reporters from around the world, from nearly 90 different countries, were buried in this pile of shredded paper for 16 months.

Remittance from Taiwan, business partner involved in fraud

A suspicious transaction report pointed out that from November 2015 to October of the following year, three Deutsche Bank accounts of iFinex triggered five Deutsche Bank alerts, with a total transaction amount of US$13.77 million (about 410 million US dollars). Taiwan dollars).

Of the 144 transactions in the report, 33 were with First Bank, 1 with Shin Kong Bank, and 1 with Kaohsiung Bank.

Deutsche Bank reported the transaction for four suspicious reasons. First, iFinex is a financial service provider and is also engaged in virtual currency transactions in high-risk industries. Second, the transaction lacks transparency and the object of the transaction is unknown. Third, the transaction does not have a clear business purpose. Fourth, the transaction areas include areas with high risk of money laundering.

The report states that iFinex has a business partner, Eugeni "Zhenya" Tsvetnenko. According to Australian media reports, the man was arrested at his home in Perth, Australia, in December last year by the New York Attorney's Office for wire fraud.

advertise

The report also pointed to iFinex's deal with Axiom Holdings in 2015. According to U.S. media reports, the company was subpoenaed by the U.S. Securities and Exchange Commission in 2017 for alleged fraud.

"World" verified 3 banks. Shin Kong Bank and Kaohsiung Bank said that they have not dealt with iFinex since 2017. The above-mentioned banks handled the business with the group at that time in accordance with the money laundering prevention regulations at that time. First Bank said it could not reply because it did not obtain relevant information.

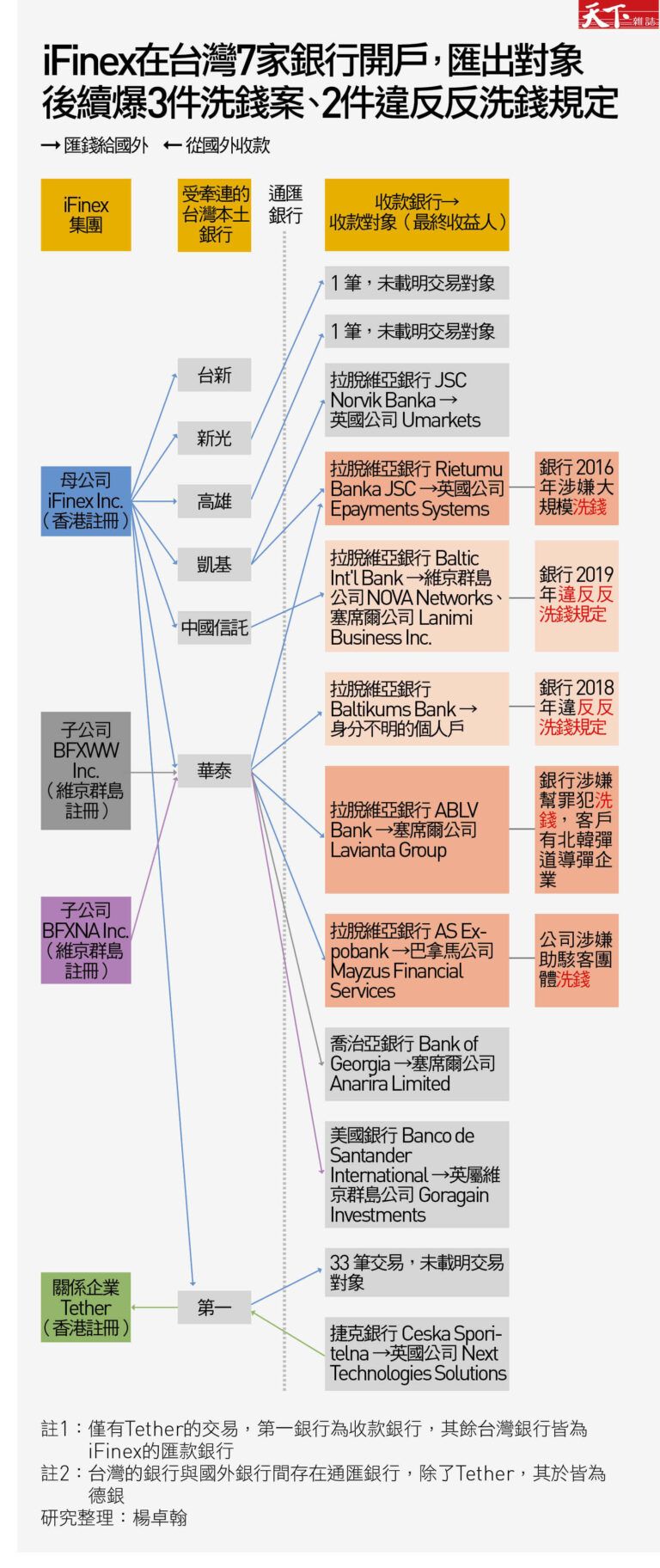

In addition to the parent company, "World" and the ICIJ data team found in the leaked data that iFinex had three other companies that also used Taiwanese banks for suspicious transactions.

Taiwan office is near the FSC

The representative of iFinex Taiwan branch "British Virgin Islands Merchant Aifei Nisi Co., Ltd." is Fang Junzhe, whose office is located at Section 1 of Wenhua Road, Banqiao. Hidden in a low-key building, only a 15-minute walk from the Golden Tube Association.

Its subsidiary Tether was established in Hong Kong and also has an office in Taiwan. There are also two Virgin Islands subsidiaries, BFXWW Inc. and BFXNA Inc.

The registered addresses of these four companies in the SAR are all at Bank of America Centre, 12 Harcourt Road, Central, Hong Kong. Interestingly, the Hong Kong Monetary Authority is on the 16th next door.

All four companies were former bank customers in Taiwan. In addition to the three mentioned in the above-mentioned Deutsche Bank report, there are China Trust, Huatai, and KGI Bank. Taishin Bank also appeared in a public court filing.

These seven Taiwanese local banks are the banks used by iFinex in Taiwan.

Transaction objects include money laundering, high-risk banks

Through Taiwan, it deals with people as far away as the Virgin Islands, Panama, and Latvia, including financial criminals.

Huatai Bank stated that iFinex was no longer a customer, and the accepted business at that time followed the laws and regulations. KGI Bank said it was unable to respond to specific customer information and that its operations were carried out in accordance with the law. China CITIC Bank stated that relevant information can only be disclosed to authorized institutions in accordance with the law. Taishin did not respond.

In April and May 2015, iFinex remitted money to other clients who opened accounts in Latvia’s Baltikums Bank and ABLV Bank through Huatai Bank.

In September and October of the same year, iFinex used the China Trust Bank OBU account to wire money to a Seychelles company that opened an account with the Baltic International Bank in Latvia.

All three Latvian banks were fined for violating money laundering norms. ABLV is also accused by the US Treasury that most of the bank's customers are high-risk shell companies, laundering billions of dollars in illicit funds, customers including Russia, Azerbaijan and Ukraine and other criminals, as well as North Korea's ballistic missile program. related companies.

ABLV is being taken over by the European Central Bank for liquidation, and the bank cannot have any comment on any customer.

The recipients of iFinex's remittance through Huatai Bank are Mayzus Financial Services, a company that has opened an account in a Latvian bank. The company was accused by anti-corruption group Global Witness in late 2019 of helping a Russian government-backed hacker group launder money for the notorious cryptocurrency money-laundering platform BTC-e.

In the suspicious transactions, iFinex used the cash flow network established in Taiwan to communicate with two types of objects: either potential objects of money laundering, or overseas companies hiding in money laundering paradise.

iFinex is a "decentralized" variant of the business. Its perfect shape: the vault is located in Taiwan, the company address is in Hong Kong, but it is actually an offshore company in the Virgin Islands. Using this complex and fragile structure, it will issue virtual currency to global investors and challenge the financial sovereignty of the United States.

The Tether issued by it is the most frequently exchanged stable currency in the bitcoin circle, so it is called the central bank of the cryptocurrency industry, but it is also often accused of manipulating the price of bitcoin. Bitcoin addresses, or accounts, on iFinex-owned exchanges were charged by the U.S. Treasury Department last year for drug trafficking.

The Tether issued by iFinex's Tether is known as the stable currency of the virtual currency circle, but it is controversial. (Shutterstock)

The Tether issued by iFinex's Tether is known as the stable currency of the virtual currency circle, but it is controversial. (Shutterstock)

"He has a passion for Taiwan"

Why did the Dutch founder Fang Junzhe set up the treasury in Taiwan? "Fang Junzhe has a passion for Taiwan," observes Hu Yitian, founder and CEO of Yuanbo Capital, who is familiar with the blockchain circle.

"He felt that Taiwan could use the power of technology to take finance to the next level. Cryptocurrency is that power."

Fang Junzhe came to Taiwan as an international student and graduated from National Taiwan University in 1988. Before founding iFinex, he had been engaged in trade in Taiwan for nearly 30 years, and served as the sales president of Tuxia, a German businessman in Taiwan, selling system software.

After founding iFinex, Fang Junzhe recruited in Taiwan. It is understood that there were more than 50 employees in Taiwan during the heyday, and the main departments included engineers, finance, legal compliance and customer service.

Zheng Guangtai, the founder of Taiwan's largest cryptocurrency exchange "Bito", is a former employee of Fang Junzhe in Desia.

"He's a visionary boss," Zheng Guangtai said. However, Zheng Guangtai had already started his own business at the time, so he did not join the party's cryptocurrency company.

In 2015, Professor Liao Shiwei from the Department of Capital and Engineering of National Taiwan University met Fang Junzhe. "At that time he spent a lot of time in Taiwan and visited a lot of government officials," said Liao Shiwei, who also had students working under Fang Junzhe.

Fang Junzhe also started classes with Liao Shiwei at the National Taiwan University of Science and Technology. It was only halfway through the semester, and only Liao Shiwei was left in class, because the treasury built by Fang Junzhe in Taiwan was being dismantled by an American bank.

Taiwan's gold flow was cut off 3 years ago

In mid-March 2017, the US banking giant Wells Fargo informed four local Taiwanese banks including First, Taishin, KGI, and Huatai that it would immediately cut off US dollar transactions with iFinex.

A month later, the lawsuit filed by iFinex pointed out that the actions of Wells Fargo caused all iFinex dollar transactions to be suspended. Because it relies on Taiwanese banks to do business with global customers.

As long as the four local banks in Taiwan are attacked, the cash flow of this global cryptocurrency central bank will be completely blocked.

"He even has difficulty doing business in Taiwan," said an anonymous industry source. "Wells Fargo immediately ordered to cut off the transaction. Which Taiwanese bank would not be afraid to see it?"

"Wells Fargo is one of the major international U.S. dollar remittance banks, and we can’t be offended," said a U.S.-based bank executive. "As long as there are foreign customers, such as Microsoft’s customers who want to send money to their own banks, they must go through the remittance bank. It's a terrible thing to cut off the account."

In addition, the year before the incident, Mega Bank's New York branch had just been severely fined by the New York authorities, and anti-money laundering has become a prominent learning. In 2017, some Taiwanese banks voluntarily settled their iFinex accounts and stopped doing business with them.

Relocated to Europe, still very close to crime

After the Wells Fargo incident, iFinex moved to Switzerland, and in 2018, it hired an anti-money laundering consultant from Royal Bank of Canada and Montreal Bank as its chief compliance officer. But the distance from financial crime is still very close.

It later cooperated with the Panamanian bank Crypto Capital. Unexpectedly, the CEO of the bank was arrested by Polish police last year on suspicion of using iFinex's exchange to launder money for Colombian drug cartels. iFinex once again suffered heavy losses due to the immobility of bank funds. The iFinex exchange declares that it is a victim of fraud.

"It grew out of a gray area on the fringes of the financial system. It will take a long time for it to be completely legal and compliant," Hu Yitian said. Fang Junzhe represents a revolution that overthrew the traditional financial system.

"Tianxia" verified the company case of iFinex and its exchange Bitfinex and the facts reported by Fang Junzhe, but still did not respond by the time of writing.

Cryptocurrency anti-money laundering, Taiwan has yet to set the tone

However, not every cryptocurrency industry is hunted down by the United States. For example, Nasdaq in the United States has cooperated with seven cryptocurrency companies that have passed the audit to track illegal activities such as money laundering.

The risk of money laundering can be effectively reduced by incorporating cryptocurrencies into the management of the financial system as soon as possible, rather than blindly blocking its cash flow.

The International Organization for Anti-Money Laundering, the Financial Action Group, issued guidelines for cryptocurrency regulation last year, requiring operators to implement traditional financial anti-money laundering international transfer rules and record the information of each cryptocurrency transfer.

"Actually, all cryptocurrency transactions can be tracked," said KuCoin CEO Osimai, whose cryptocurrency anti-money laundering solution "Sygna" is designed to prevent loopholes. Both domestic currency trust and MAX exchanges have been imported.

At present, Singapore has passed the "Payment Services Act", which regulates exchanges and requires operators to comply with international transfer rules. However, Taiwan's competent authorities have not yet proposed a draft of anti-money laundering norms for cryptocurrency companies.

Taiwan was awarded the highest rating last year by the Asia-Pacific Group for the Prevention of Money Laundering (APG), the FSC said. Both the public and private sectors of Taiwan are fully committed to implementing international money laundering prevention and control norms.

The draft regulations on the prevention of cryptocurrency money laundering have been drafted, and we are constantly communicating with local cryptocurrency industry players in Taiwan to meet relevant international standards.

Three strings of numbers and one cryptocurrency exchange put Taiwan's financial industry in danger of money laundering. If the competent authorities do not speed up the response, Mega was fined NT$5.7 billion by the United States, a new high in Taiwan's history, and may be broken. (Editor in charge: Wang Lihua)

related articles

Comments are closed

comments powered by Disqus